Estate Planning

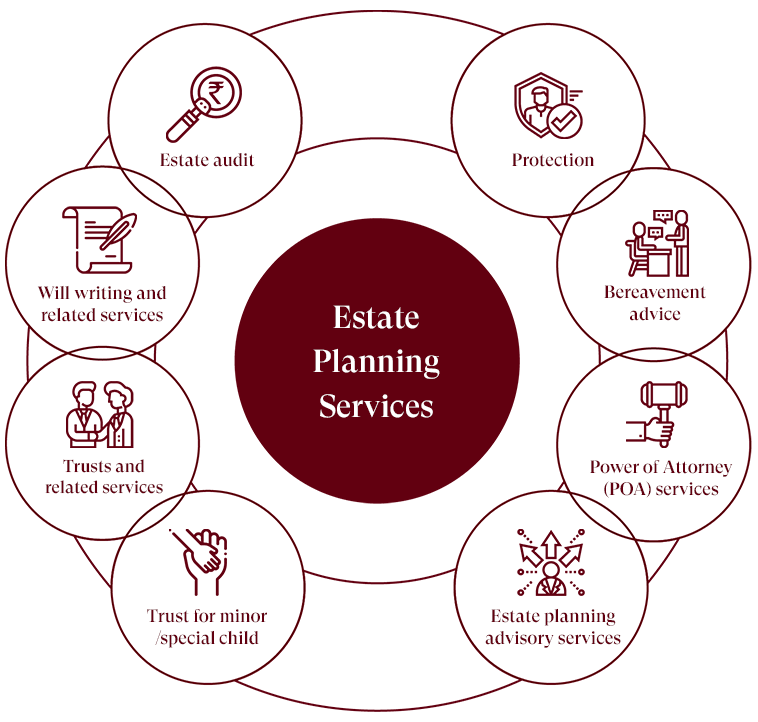

Estate planning is an essential part of securing your legacy and ensuring that your assets are distributed according to your wishes. At SK WEALTHY MIND, our comprehensive estate planning services help you take control of your financial future, protect your loved ones, and avoid potential legal challenges.

Estate planning involves preparing for the management and distribution of your assets after your passing. It includes creating a will, establishing trusts, designating beneficiaries, and planning for taxes and other expenses. A well-structured estate plan ensures that your property, investments, and other assets are transferred smoothly to your heirs while minimizing legal complications and taxes.

Estate planning tasks include making a will, setting up trusts, making charitable donations to limit estate taxes, naming an executor and beneficiaries, and setting up funeral arrangements. A will gives instructions about property and custody of minor children.

Key Components of Estate Planning

| Wills and Trusts | |

| Your will is the cornerstone of your estate plan, detailing how you want your assets distributed. Trusts provide additional flexibility, allowing you to manage and distribute wealth during your lifetime and beyond, with benefits like tax reduction and privacy protection. | |

| Power of Attorney | |

| Estate planning includes designating a power of attorney to manage your financial and legal affairs if you become unable to do so yourself. This ensures your interests are protected even in unforeseen circumstances. | |

| Healthcare Directives | |

| Advance healthcare directives allow you to specify your preferences for medical care if you become incapacitated. This important part of estate planning ensures that your healthcare decisions are respected. | |

| Beneficiary Designations | |

| Properly designating beneficiaries for your retirement accounts, insurance policies, and other assets is crucial in estate planning. This step ensures that your assets go directly to the intended recipients without delays or disputes. | |

| Tax Planning | |

| Estate planning also involves strategies to reduce estate taxes, ensuring that more of your wealth is preserved for your heirs. By carefully planning your estate, you can minimize the tax burden on your beneficiaries. |

Why is Estate Planning Important?

Estate planning is not just for the wealthy—it’s vital for anyone who wants to protect their loved ones and ensure their wishes are honored. Without a clear plan, your estate could be subject to lengthy probate processes, disputes, and significant taxes. Estate planning offers peace of mind by giving you control over how your assets are managed and distributed, helping avoid legal complications and ensuring your family is cared for.

Our Approach to Estate Planning

At SK WEALTHY MIND, we take a personalized approach to estate planning, understanding your unique goals and creating a plan that meets your needs. Whether you want to protect your assets, provide for future generations, or support charitable causes, our estate planning services ensure your legacy is secure.

Estate planning allows individuals to clearly define their wishes, minimizing the potential for disputes among heirs and reducing the likelihood of legal complications. Risk Management: Estate and succession planning enable individuals to manage risk by ring-fencing assets from potential legal threats .

Estate planning allows you to specify how you want your assets to be distributed after your death. This can provide peace of mind, knowing that your assets will be distributed according to your wishes, rather than being decided by a court.

Why Choose Our Estate Planning?

Choosing the right estate planning service is essential for protecting your assets, securing your legacy, and ensuring that your wishes are carried out exactly as you intend. At SK WEALTHY MIND, we offer expert estate planning solutions tailored to your unique needs and goals. Here’s why our estate planning service stands out:

| Personalized Estate Planning Solutions | |

| We understand that every client’s situation is unique. Our estate planning service is customized to reflect your personal values, financial goals, and family dynamics. We take the time to listen and understand what’s most important to you, creating a plan that honors your wishes and protects your loved ones. | |

| Comprehensive Legal and Financial Expertise | |

| Our team consists of experienced professionals who are well-versed in estate planning laws and strategies. Whether it’s drafting wills, setting up trusts, or navigating complex tax laws, our estate planning experts ensure that every detail is managed with precision and care. | |

| Holistic Approach to Financial Planning | |

| Estate planning is a critical component of your overall financial strategy. We integrate estate planning into your broader financial plan, considering all aspects of your wealth management, retirement goals, and legacy intentions. This holistic approach ensures that your estate plan aligns seamlessly with your financial objectives. | |

| Proactive Tax Planning | |

| A significant aspect of estate planning is minimizing the tax burden on your beneficiaries. Our estate planning service includes strategic tax planning to help preserve more of your wealth for your heirs. We provide solutions that reduce estate taxes, capital gains, and other liabilities, ensuring that your assets are transferred efficiently. | |

| Ongoing Support and Plan Adjustments | |

| Your life and financial circumstances can change, and so should your estate plan. We offer continuous support, regularly reviewing and updating your estate plan as needed. Whether it’s a change in family structure, new assets, or evolving goals, we make sure your estate plan stays relevant and effective. | |

| Transparent and Client-Centered Advice | |

| We prioritize your best interests at every step of the estate planning process. Our advice is clear, unbiased, and focused solely on your goals. With our transparent approach, you can trust that your estate plan is designed to meet your needs, free from conflicts of interest. | |

| Peace of Mind and Legacy Protection | |

| Estate planning is about more than just distributing assets—it’s about leaving a legacy and providing peace of mind for you and your loved ones. By choosing our estate planning service, you ensure that your legacy is protected, your wishes are honored, and your family’s future is secured. |