Corporate Risk Management

In today’s complex business environment, managing risks is crucial for sustaining growth and ensuring long-term success. Our corporate risk management services help businesses identify, assess, and mitigate risks that could impact their operations, profitability, and reputation. At SK WEALTHY MIND, we provide comprehensive strategies to safeguard your company’s assets, processes, and future.

Corporate risk management involves the systematic identification and mitigation of potential threats to an organization’s objectives, assets, and operations. It includes analyzing risks across various areas such as financial, operational, strategic, compliance, and reputational risks. Effective corporate risk management enables businesses to make informed decisions, enhance resilience, and capitalize on opportunities while minimizing threats.

Simply put, risk management aims to protect an organization from potential losses or threats to its continued operation. This can include financial losses, damage to the organization’s reputation, or harm to employees.

Key Elements of Corporate Risk Management

| Risk Identification | |

| The first step in corporate risk management is identifying potential risks that could affect your business. Our experts conduct thorough assessments to uncover vulnerabilities in your operations, financial strategies, and compliance frameworks. | |

| Risk Assessment and Analysis | |

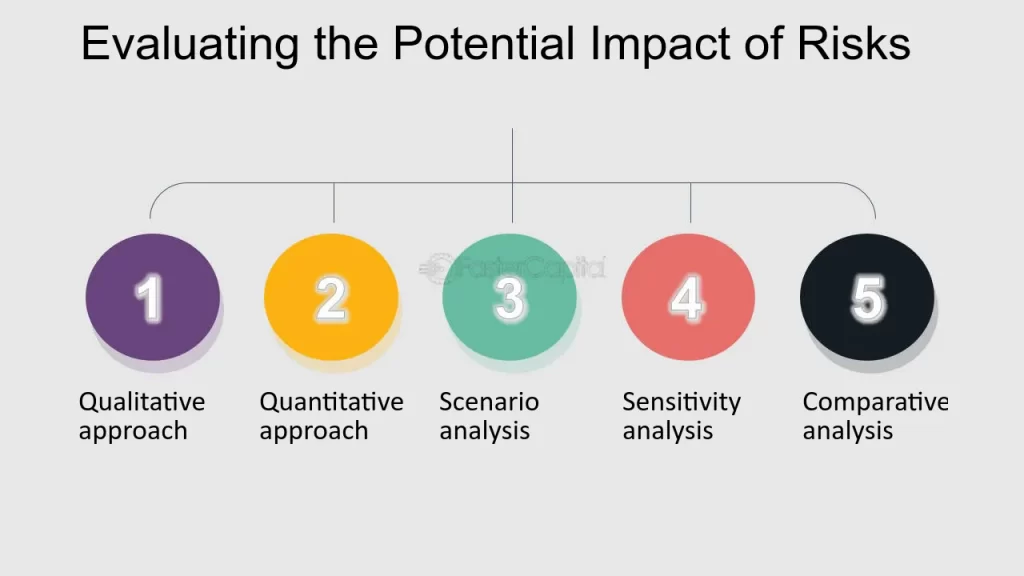

| Once risks are identified, we evaluate their potential impact and likelihood. Our corporate risk management process involves detailed analysis to prioritize risks based on their severity and the level of exposure they present to your business. | |

| Risk Mitigation Strategies | |

| We develop tailored strategies to mitigate identified risks, focusing on minimizing their impact on your operations. Whether it’s implementing stronger internal controls, diversifying revenue streams, or enhancing cybersecurity measures, our solutions are designed to protect your business. | |

| Compliance and Regulatory Risk Management | |

| Staying compliant with industry regulations and standards is a key aspect of corporate risk management. We help you navigate complex regulatory requirements, ensuring your business remains compliant and avoids costly penalties or legal challenges. | |

| Business Continuity Planning | |

| A robust business continuity plan is essential for minimizing disruptions during crises. Our corporate risk management services include creating contingency plans that ensure your business can continue operating smoothly, even in adverse situations like natural disasters, economic downturns, or supply chain disruptions. | |

| Monitoring and Continuous Improvement | |

| Risk management is an ongoing process. We continuously monitor and review your risk management strategies, making necessary adjustments as your business evolves and new risks emerge. This proactive approach ensures that your company remains resilient in an ever-changing environment. |

Why is Corporate Risk Management Important?

Corporate risk management is essential for protecting your company’s financial health, reputation, and long-term viability. Without a proactive risk management strategy, businesses expose themselves to unexpected challenges that can lead to significant financial losses, operational disruptions, and reputational damage. Effective corporate risk management not only safeguards against threats but also positions your business to take advantage of opportunities with confidence.

Good risk management helps to calculate uncertainties. It helps the businesses to be ready with the prediction and influence on the businesses. Risk management helps to plan, organize, control budgeting, and control costs while proactively controlling the risks.

Why Choose Our Corporate Risk Management Service?

At SK WEALTHY MIND, we bring a wealth of experience and expertise in helping businesses manage risks effectively. Our corporate risk management solutions are customized to meet the unique needs of your company, ensuring comprehensive protection across all areas of your operations. With a focus on strategic planning, compliance, and proactive mitigation, we help you navigate uncertainties while keeping your business on the path to success.

In a world where business risks are constantly evolving, having the right partner to manage those risks is essential. At SK WEALTHY MIND, we provide expert corporate risk management services that not only protect your business but also enable it to thrive. Here’s why you should choose us:

| Customized Risk Management Strategies | |

| We understand that every business faces unique risks. Our approach to corporate risk management is tailored to your specific industry, operations, and objectives. We develop customized solutions that align with your company’s goals, ensuring comprehensive risk coverage. | |

| Experienced Risk Management Experts | |

| Our team consists of seasoned professionals with deep expertise in identifying and mitigating risks across various sectors. With years of experience, we offer insights and strategies that address the complexities of modern business environments, helping you stay ahead of potential threats. | |

| Proactive Risk Mitigation | |

| We believe in taking a proactive approach to risk management. Instead of merely reacting to risks as they occur, we focus on anticipating potential challenges and implementing measures to prevent them. This forward-thinking approach keeps your business resilient and better prepared for uncertainties. | |

| Integrated Risk Management Solutions | |

| Risk management doesn’t operate in isolation. We provide integrated solutions that encompass financial, operational, compliance, and strategic risks, giving you a holistic view of your business’s risk landscape. Our comprehensive approach ensures that all aspects of your risk profile are effectively managed. | |

| Focus on Compliance and Regulatory Excellence | |

| Navigating complex regulatory environments can be challenging. Our corporate risk management service includes robust compliance strategies that keep your business aligned with ever-changing regulations. We help you avoid costly penalties, legal issues, and reputational damage by ensuring that your operations remain compliant. | |

| Business Continuity and Resilience Planning | |

| Our risk management solutions go beyond just minimizing threats. We help you build a resilient business capable of withstanding disruptions. From crisis management plans to business continuity strategies, we ensure that your operations can continue smoothly even in the face of unexpected events. | |

| Data-Driven Decision Making | |

| We leverage advanced analytics and data-driven insights to assess risks and craft effective mitigation strategies. By using accurate data and sophisticated tools, we provide you with actionable information that drives smarter decisions and enhances your risk management outcomes. | |

| Long-Term Partnership | |

| We are more than just service providers; we are your long-term partners in risk management. Our commitment to your success means that we are always available to support you, adapt strategies as your business evolves, and provide guidance whenever new risks emerge. | |

| Transparent and Ethical Practices | |

| Trust and integrity are at the core of our services. We operate with complete transparency, providing clear, unbiased advice and solutions that prioritize your business’s best interests. You can rely on us to act with professionalism and ethical responsibility in all our dealings. |