Retirement Plan

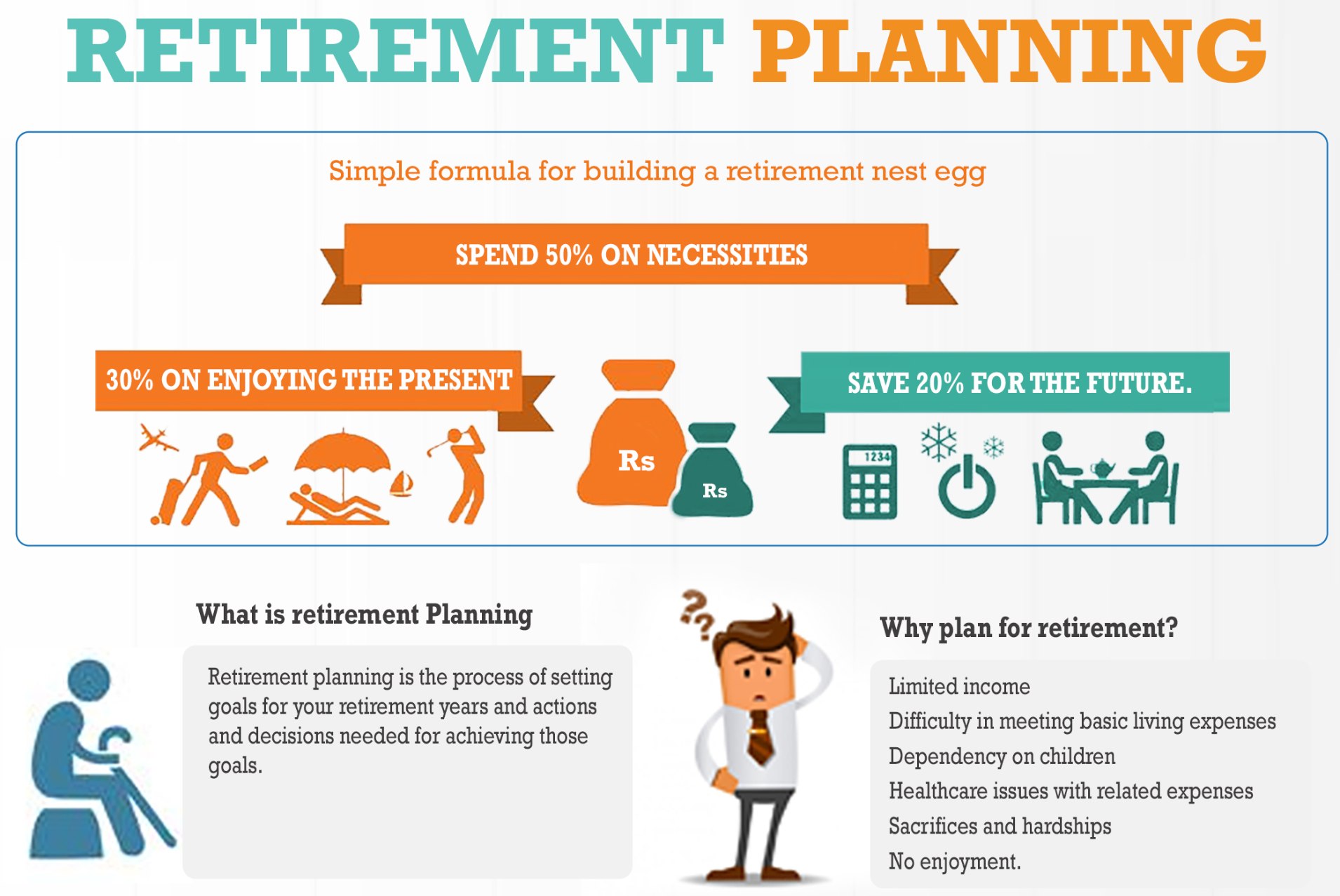

A retirement plan is a financial strategy designed to ensure that you have sufficient funds to support yourself during retirement. It involves saving, investing, and managing money throughout your working years to provide for a comfortable and secure retirement.

A retirement plan is designed to take care of your post-retirement days and help you lead a stress-free life. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. Such plans help you set aside some amount towards your retirement while you are still working.

A retirement plan is a strategy for long-term saving, investing, and finally withdrawing money you accumulate to achieve a financially comfortable retirement.

If you’re near or in retirement, bonds, annuities, and income-producing equities can offer additional retirement income beyond Social Security, a pension, savings and other investments. A financial professional can help you determine the most appropriate retirement income strategy for your circumstances.

Benefits of Retirement Planing

| Financial Security | |

| A well-structured retirement plan provides financial security and peace of mind, ensuring that you have sufficient funds to cover your living expenses in retirement. | |

| Peace of Mind | |

| Knowing that you have a plan in place helps reduce anxiety about your financial future and allows you to enjoy your retirement with confidence. | |

| Income Management | |

| A retirement plan helps you manage your income effectively, providing a steady stream of funds to support your desired lifestyle and cover unforeseen expenses. | |

| Tax Advantages | |

| Many retirement accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals, which can enhance your savings and reduce your tax burden. | |

| Flexibility | |

| With a well-designed plan, you have the flexibility to adjust your savings, investments, and withdrawals based on changing circumstances and goals. | |

| Legacy Planning | |

| A retirement plan can include provisions for passing on wealth to family members or charitable organizations, allowing you to leave a lasting legacy. |

Why choose our Retirement Plan

Choosing our retirement plan offers several distinct advantages tailored to help you achieve a secure and comfortable retirement. Here’s why our plan might be the right choice for you:

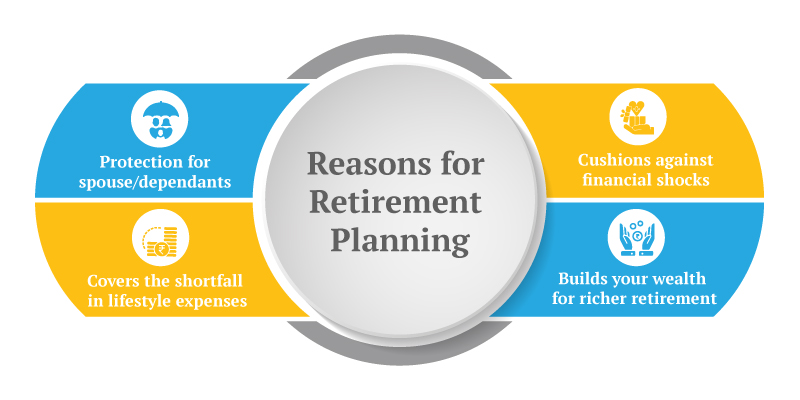

| Comprehensive Planning | |

| Our retirement plan provides a holistic approach to retirement savings and management. We consider all aspects of your financial future, including income needs, investment strategies, healthcare costs, and estate planning. This comprehensive planning ensures that all your retirement needs are addressed. | |

| Personalized Strategy | |

| We offer personalized retirement planning services to tailor the plan to your specific goals, risk tolerance, and financial situation. This individualized approach helps create a strategy that aligns with your retirement vision and maximizes your chances of success. | |

| Tax Efficiency | |

| Our plan incorporates tax-efficient strategies to optimize your retirement savings. We help you take advantage of various tax-advantaged accounts and investment opportunities, ensuring that you minimize your tax burden and maximize your returns. | |

| Diverse Investment Options | |

| We provide access to a wide range of investment options, including stocks, bonds, mutual funds, and other vehicles. Our investment strategies are designed to diversify your portfolio and balance risk with potential returns, helping you achieve steady growth over time. | |

| Ongoing Support | |

| Our commitment to your retirement doesn’t end with the initial plan. We offer ongoing support and regular reviews to monitor your progress and adjust the plan as needed based on changes in your financial situation, market conditions, or retirement goals. | |

| Expert Guidance | |

| Our team of experienced financial advisors is dedicated to guiding you through the complexities of retirement planning. We provide expert advice and insights to help you make informed decisions and navigate any challenges that may arise. |

| Flexible Contributions | |

| We offer flexible contribution options to accommodate your changing financial circumstances. Whether you want to increase contributions during peak earning years or adjust them during periods of lower income, our plan can adapt to your needs. | |

| Retirement Income Planning | |

| Our plan includes detailed strategies for managing and withdrawing your retirement funds effectively. We help you create a sustainable income plan that provides for your needs while preserving your assets for the long term. | |

| Healthcare Planning | |

| We address healthcare costs in our retirement planning, helping you prepare for medical expenses and insurance coverage. This includes guidance on Medicare, long-term care insurance, and other healthcare considerations. | |

| Legacy Considerations | |

| If leaving a financial legacy is important to you, our plan includes options for estate planning and wealth transfer. We help you structure your assets to ensure that your wishes are met and your beneficiaries are provided for. | |

| Proven Track Record | |

| Our retirement plan is backed by a proven track record of success. We have helped many clients achieve their retirement goals through diligent planning, strategic investments, and personalized service. | |

| Transparent Fees | |

| We prioritize transparency in our fee structure, ensuring that you understand the costs associated with your retirement plan. There are no hidden fees, and we provide clear explanations of how our services are priced. |

By choosing our retirement plan, you benefit from a well-rounded approach to planning, expert guidance, and tailored strategies designed to help you achieve a secure and fulfilling retirement.