Wealth Management

Achieving and maintaining financial success requires more than just investment decisions; it requires a strategic, comprehensive approach to wealth management. Our wealth management service is designed to provide you with personalized financial planning, ensuring that your assets are managed effectively while aligning with your long-term goals.

Wealth management is a holistic financial planning service that combines investment management, financial advice, and tailored strategies to grow, preserve, and distribute wealth. It’s about creating a financial roadmap that not only considers your current needs but also your future aspirations, including retirement, legacy planning, and wealth transfer.

Wealth management is a branch of financial services dealing with the investment needs of affluent clients. These are specialised advisory services catering to the investment management needs of affluent clients.

Key Features of Our Wealth Management Service

| Personalized Financial Planning | |

| We start by understanding your unique financial situation, goals, and risk tolerance. Our financial planning approach is fully customized to ensure that your wealth management strategy reflects your personal objectives and values. | |

| Investment Management | |

| Effective wealth management involves selecting and managing the right mix of assets. We develop a diversified investment portfolio tailored to your goals, balancing growth opportunities with risk management. | |

| Tax Optimization Strategies | |

| A well-structured financial plan should minimize tax liabilities. We incorporate tax-efficient strategies into your wealth management plan, helping you retain more of your wealth and maximize after-tax returns. | |

| Risk Management and Protection | |

| Protecting your wealth is as important as growing it. We assess potential risks and recommend appropriate insurance and risk management solutions as part of your comprehensive financial plan. | |

| Estate and Legacy Planning | |

| Your financial planning goals may include leaving a legacy for your loved ones or supporting charitable causes. Our wealth management service provides guidance on estate planning, wealth transfer, and charitable giving to ensure your wishes are fulfilled. |

Why Choose Our Wealth Management Service?

At SK WEALTHY MIND, our wealth management service is built on trust, expertise, and a deep understanding of your financial aspirations. With our holistic financial planning approach, we offer:

| Comprehensive Solutions | |

| We address every aspect of your financial life, integrating investment strategies, tax planning, and estate planning into one cohesive plan. | |

| Personalized Attention | |

| Your financial needs are unique, and so is our approach. We take the time to understand your goals, providing tailored advice that evolves as your circumstances change. | |

| Proven Expertise | |

| Our experienced financial planners and wealth managers bring industry-leading knowledge to manage your wealth effectively, helping you achieve lasting financial success. |

Because wealth management allows you to directly impact the state of the economy in your country, it offers a very fulfilling career path. You can achieve this through making lucrative investments and tailoring your offerings to fit the needs of various clientele groups.

Why is Wealth Management Service Important?

Wealth management is a key component of comprehensive financial planning, offering tailored strategies to help individuals and families achieve long-term financial security and growth. As financial situations become more complex, having a professional wealth management service is essential for optimizing your financial resources. Here’s why wealth management service is so important:

| Strategic Financial Planning | |

| Wealth management is more than just investment advice; it’s a comprehensive financial planning service that encompasses everything from retirement planning to tax strategies. With a personalized approach, wealth management ensures that your financial goals are clearly defined and that the path to achieving them is well-structured. | |

| Risk Management and Asset Protection | |

| One of the key aspects of financial planning is managing risks. Wealth management helps identify potential financial risks and implements strategies to protect your assets. Whether it’s market volatility, health issues, or unforeseen life events, a solid wealth management plan mitigates risks and provides peace of mind. | |

| Customized Investment Strategies | |

| A one-size-fits-all investment strategy doesn’t work for everyone. Wealth management services offer tailored investment solutions that align with your financial objectives, time horizon, and risk tolerance. This personalized approach ensures that your investments are optimized for growth while balancing the level of risk you are comfortable with. |

| Tax Efficiency | |

| Effective financial planning must include tax considerations. Wealth management services focus on tax-efficient investment strategies, helping you maximize returns while minimizing tax liabilities. By strategically managing your assets and income, you can retain more of your wealth for future growth and personal goals. | |

| Long-Term Financial Security | |

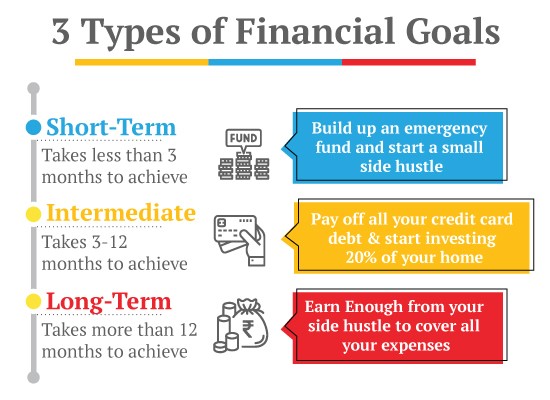

| Wealth management ensures that your financial plan is aligned with both your short-term needs and long-term objectives. From planning for major life milestones to leaving a legacy for your loved ones, wealth management provides a structured approach to building and preserving wealth over time. | |

| Simplified Financial Decision-Making | |

| With multiple financial goals and investment options, decision-making can become overwhelming. A wealth management service simplifies this process by providing expert guidance and comprehensive financial planning. Your wealth manager acts as a trusted partner, helping you navigate complex financial choices with confidence. | |

| Estate and Legacy Planning | |

| For those looking to preserve wealth for future generations, wealth management is crucial. It incorporates estate planning and wealth transfer strategies, ensuring that your assets are distributed according to your wishes while minimizing potential tax implications. |